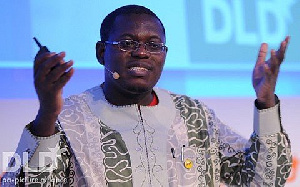

The vice president of IMANI Africa, Bright Simons, has said that the debt restructuring exercise announced by Finance Minister Ken Ofori-Atta is nothing more than the government defaulting on its debt obligations.

In a series of tweets shared on Sunday, December 12, 2022, Simons said that this would be the first time in nearly 40 years that the government of Ghana would fail to pay its debtors.

The IMANI vice president added that the last time the government defaulted on its debts was in 1972.

“The deed is done. Ghana has unilaterally announced a default. First time since 1982. In certain like-for-like respects though it is the 1st time since the 1972 commercial loan default.

“The question on everyone’s mind is: would things be smooth or rough with the other steps ahead?” parts of the series of tweets read.

The Minister of Finance announced a number of measures under government’s Domestic Debt Exchange (DDE) programme late Sunday.

He stated in a 4-minute address that the announcement was in line with government’s Debt Sustainability Analysis as contained in the 2023 budget he presented to Parliament on November 24.

The Minister laid out among others the exchange of existing domestic bonds with four new ones as well as their maturity dates and terms of coupon payments.

He also addressed the overarching goal of the government relative to its engagements with the International Monetary Fund as well as measures to minimize impact of domestic bond exchange on different stakeholders.

“The Government of Ghana has been working hard to minimize the impact of the domestic debt exchange on investors holding government bonds, particularly small investors, individuals, and other vulnerable groups,” he said before outlining three main measures:

• Treasury Bills are completely exempted and all holders will be paid the full value of their investments on maturity.

• There will be NO haircut on the principal of bonds.

• Individual holders of bonds will not be affected.

View the MPs tweet below:

The deed is done.

Ghana has unilaterally announced a default. First time since 1982. In certain like-for-like respects though it is the 1st time since the 1972 commercial loan default. The question on everyone's mind is: would things be smooth or rough with the other steps ahead? pic.twitter.com/EBU28EzTYN— Bright Simons (@BBSimons) December 4, 2022

Source: