President and Founder of IMANI Africa, Franklin Cudjoe has disclosed that he has lost over GH¢100,000 of his investment due to the ongoing debt restructuring programme by the government.

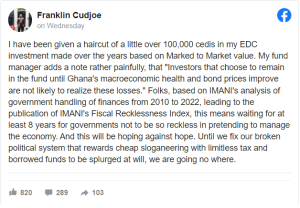

In a post shared on Facebook on Wednesday, Franklin Cudjoe berated the government for the poor management of the economy.

He urged Ghanaians to critically evaluate the persons they vote for to lead the country.

“I have been given a haircut of a little over 100,000 cedis in my EDC investment made over the years based on Marked to Market value. My fund manager adds a note rather painfully, that ‘Investors that choose to remain in the fund until Ghana’s macroeconomic health and bond prices improve are not likely to realize these losses’.

“Folks, based on IMANI’s analysis of government handling of finances from 2010 to 2022, leading to the publication of IMANI’s Fiscal Recklessness Index, this means waiting for at least 8 years for governments not to be so reckless in pretending to manage the economy.

“And this will be hoping against hope. Until we fix our broken political system that rewards cheap sloganeering with limitless tax and borrowed funds to be splurged at will, we are going nowhere,” he said.

The Minister of Finance announced a number of measures under government’s Domestic Debt Exchange (DDE) programme late Sunday.

He stated in a four-minute address that the announcement was in line with government’s Debt Sustainability Analysis as contained in the 2023 budget he presented to parliament on November 24.

The minister laid out, among others, the exchange of existing domestic bonds with four new ones as well as their maturity dates and terms of coupon payments.

He also addressed the overarching goal of the government relative to its engagements with the International Monetary Fund as well as measures to minimize impact of domestic bond exchange on different stakeholders.

“The Government of Ghana has been working hard to minimize the impact of the domestic debt exchange on investors holding government bonds, particularly small investors, individuals, and other vulnerable groups,” he said before outlining three main measures:

• Treasury Bills are completely exempted and all holders will be paid the full value of their investments on maturity.

• There will be NO haircut on the principal of bonds.

• Individual holders of bonds will not be affected.

View the IMANI president’s post below:

https://web.facebook.com/franklin.cudjoe/posts/10160376682837349

Source: ghanaweb.com