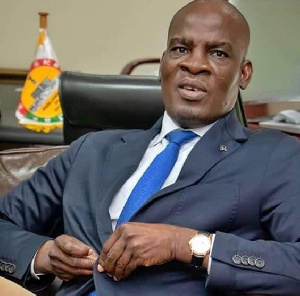

The Minority Leader, Haruna Iddrisu has cautioned the government, particularly President Akufo-Addo to stem any forcible implementation of the proposed debt exchange programme and rather consult exhaustively on the way forward.

He said the government borrowed enough to push the country into a financial ditch, and therefore the government cannot arrogantly ignore the concerns of bondholders and proceed to implement its widely opposed debt exchange programme.

Haruna was addressing a press conference in Parliament to state the position of the Minority on the government’s deadline for bondholders to sign onto the debt exchange programme or face dire consequences.

According to the Minority Leader, President Akufo-Addo would be disrespecting public opinion at his own political peril, because the economic mess and proposed debt exchange programme were about people’s livelihood.

“It is about people’s lives and livelihoods, let them be reminded that even the accompanying legislation on investment in bonds requires that 75 percent of it be invested in those government treasuries.

“The state of our economy as I have stated, the economy which is standing in default to its creditors both domestic and international, we are witnessing –to paraphrase the words of Nana Addo Dankwa the President- a rapidly depreciating currency, hyper-inflation and rising interest rates, excruciating cost of living and we have no fear of contradiction as a minority to say that there are considerable economic hardships in our country better than it was in January 2017,” he said.

Describing his profile of the economy as just a few symptoms of the malaise thrust on the economy under the supervision of President Akufo-Addo and his economic management team chaired by Vice President Bawumia, the Minority Leader said the prevailing economic hardship is worse than it was when President Akufo-Addo and his team took over the realms of government in January 2017.

“You know in the 2020 elections in particular, they consigned fiscal discipline to the dustbin and resorted to high expenditure, populist and misguided programmes which have contributed immensely to the accumulation of Ghana’s current unsustainable public debt.

“The indubitable but dire consequence of this irresponsible and reckless borrowing is what is now affecting all of us, including banks, insurance companies, and individual bondholders.

“Even when it became abundantly clear that an IMF programme was the surest way to halt the decline of the Ghanaian economy and restore badly needed investor confidence, you recall Alhaji Dr Bawumia and his economic management team preferring instead to sell a dubious narrative that they have the capacity to resolve the challenges without external interventions and that they would not go to the IMF.”

Haruna Iddrisu expressed the fear of the minority that the $3 billion IMF interventionist support may not materialise after all, given the requirements Ghana must meet to access the support.

Meanwhile, the Government has extended the deadline for bondholders to sign onto the debt exchange programme to January 31, 2022.

Source: otecfmghana.com