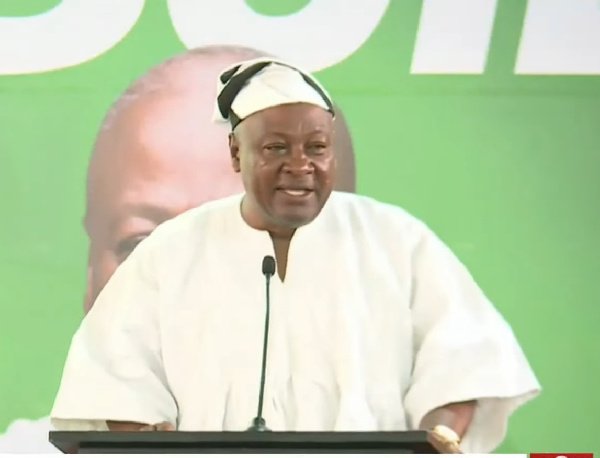

SPEECH: KEYNOTE PRESENTATION BY HE JOHN DRAMANI MAHAMA ON ASSET VALUATION AS A GLOBAL ANTI-CORRUPTION TOOL AT THE 53RD ANNUAL CONFERENCE OF THE NIGERIAN INSTITUTION OF ESTATE SURVEYORS & VALUERS, ILORIN- KWARA STATE.

Mr President, the Governing Council, and the entire membership of the NIESV, please accept my sincere gratitude for this invitation. I am also grateful to the Governor of Kwara State and my brother Abdul-Rahman Abdul-Razaq, for graciously acting as my host and landlord.

Let me also compliment you, members of the Institution, for your immense contribution to Nigeria’s national development, policy advocacy and formulation on housing, land compensation payment, property rating, land administration, and management.

I am impressed with the twenty-five (25) Professional Groupings under the Institution (NIESV) and the existence of fifty-nine (59) Branches across the country. I admire the vibrancy and discipline of the NIESV.

Ladies and gentlemen, corruption can be described as an instrument of murder because its effects can lead to loss of citizens lives due to deprivation of critical public infrastructure and services. Surveyors, Architects, and Engineers who sign-off on poorly constructed or shoddy infrastructure projects like roads, bridges, buildings, and railways can lead to loss of lives due to fatal accidents.

Because corruption is a global challenge, its scope and seriousness have led to calls for a worldwide response and cooperation in the fight against it. Corruption is an economic malady. It means different things in different contexts, but, my brothers and sisters, whichever form it takes and no matter the context, corruption is a feature of poor governance and ethics in both public and private sectors.

And we all know why. Graft thrives due to the layered irresponsibility of institutions and state actors that must fight it. The World Bank explains corruption as the abuse of public office for private gain in the public sector. On the other hand, Transparency International (TI) says corruption within the private sector is the misuse of entrusted power for personal gain.

Whichever way you visualise it, corruption must be fought whether it occurs in the public or private sector.

Your Excellency Governor, distinguished guests, there are at least three elements required for corruption to occur. First, someone must have discretionary power, which includes the ability to influence the formulation of regulations and administer them. Second, economic rent must be associated with discretionary power, primarily when higher rents are related to the misuse of discretionary power. Third, when the governance or legal system offers a sufficiently low probability of detection or sanction for wrongdoing.

The World Economic Forum estimates suggest that the global cost of corruption is at least US$2.6 trillion. This equals 5 per cent of the global gross domestic product (GDP). The World Bank has also disclosed that businesses and individuals pay more than $1 trillion in bribes yearly.

This being the case, the international community, and I am talking about development partners, international organisations, non-governmental organisations, academic experts, and professional bodies, continue to advocate an integrated and comprehensive approach to fighting corruption worldwide.

Among the approaches and initiatives adopted by the international community are the United Nations Convention Against Corruption, the United Nations Convention against Transnational Organized Crime, the United Nations Declaration against Corruption and Bribery in International Commercial Transactions, the International Code of Conduct for Public Officials and Nationals, as well as International Codes of Conduct for Professionals. The African Union Convention on Preventing and Combating Corruption is another germane instrument.

While these initiatives have had a variable impact at stopping illicit financial flows, definitely more needs to be done using all instruments available to the international community and individual nations in the fight against corruption. The advocacy of these international agencies and initiatives is highly commendable, especially as it relates to the pervasive and negative impact of corruption on economic growth and development of nations.

Empirical evidence shows that because of its secrecy, corruption distorts incentives and market signals and aggravates economic distortions. This is because enormous productive resources, such as human talent, which should be channelled to constructive engagements, are diverted into rent-seeking activities for financial rewards and further into escaping detection and punishment.

Mr Chairman, corruption hinders economic development, diverts investments from infrastructure, institutions, and social services, and undermines efforts to achieve other country-specific development goals and targets. Corruption also retards growth because bribes paid by investors to secure investment licenses, including building permits, increase the cost of doing business and, consequently, reduces the incentive to invest in a country.

Corruption also has adverse effects on productivity. If the permits and licenses needed by innovators or new producers are obtained by paying bribes, that could impede the entry of new goods or technology onto the markets of many economies.

Specifically, the impact of corruption in our nation states show that high corruption rates contribute to high inflation rates. Corruption-induced inflation contributes to high cash and unproductive capital inflows into an economy and leads to macroeconomic instability. These eventually impact microeconomic activities as prices of goods and services and the cost of living in general increase, culminating in labour agitation for commensurate increases in wages and salaries.

The Central Bank is then compelled to respond with policies to help reduce inflation and achieve price stability. Some of these policies include monetary measures that increase the primary lending rates of banks through the base rates to induce low lending till the excess cash is mopped up from the system. This is certainly inimical to the growth of businesses that rely on credit to survive. This relates to SMEs in particular.

Also, because of our current interconnectedness, we have open economies that allow the easy transfer of funds, which often could include financial rewards from corruption related activities. Corruption, therefore, has the negative effect of robbing a country of productive capital gained from graft because the proceeds may be transferred to foreign bank accounts.

The practice of capital flight from corruption will worsen the growth of developing countries if the international community does not enforce the Conventions and Declarations against corruption.

Mr Chairman, the international community has embarked on a global anti-corruption fight across several sectors, including real estate. We all admit, without question, that the real estate sector remains a very vibrant sector whose economic health impacts every sector of an economy.

Real estate is a factor of production in the same light as labour and capital. Real estate provides unique, tangible, and intangible benefits that attract investors. Compared to other asset classes, real estate investment, studies have shown, is a store of value, a hedge against inflation, and a good portfolio for investment diversification. Real estate investment serves as a cash flow stream from tenant’s rent payments.

In 2022, a Real Estate Market Size Report revealed that the size of the professionally managed global real estate investment market increased from US$10.5 trillion in 2020 to US$11.4 trillion in 2021. The estimates were from 37 markets in America, Europe, the Middle East, Africa, and Asia Pacific. Keep in mind that COVID-19 was ravaging the world between 2020 and 2021.

Therefore, real estate asset and property valuation are a critical factor in asset investment decision-making and a vital tool for the global fight against corruption. Asset valuation is an exercise conducted by professionals in public agencies, private companies, organisations, and individual professionals.

Considering the heavy reliance on physical asset collateralisation by our financial intermediation systems, including government-required performance bonds, the mechanisms deployed for asset valuation must be scientific, transparent, and credible.

Unfortunately, despite the good aspirational intents, African countries have frequently been bedevilled with the ripple effects of skewed valuations driven by the wilful narrow ends of a few.

Considering the enormity of the consequences of perversely attributed values to assets, asset valuation deservedly demands and requires increased attention from critical actors, such as the Nigerian Institution of Estate Surveyors and Valuers. Similar attention is also needed from your counterparts in my country, Ghana, and across the globe.

I dare say that among several vices, dubious valuation for assets that are used as collateral deposited with financial institutions or for business valuations during Initial Public Offering (IPOs), mergers and acquisitions are at the top of the list of potential dangers to the growth of the private sector.

Our fragile financial intermediation systems’ security and growth face significant risks from poorly done asset valuation. To remain relevant in pursuing economic and social progress and distributive justice and equity, you as professionals must rise to the occasion and create a more responsive regime to aid Africa’s renaissance and growth.

You must work to build Africa as a centre of excellence in the asset valuation space. It is possible for Africa to offer global leadership in this sector, the same way we have done in leading the world in the deployment of mobile and e-money.

A multifaceted interventionist approach is required to improve the asset and business valuation environment to restore credibility in the operational mechanisms deployed by professionals in this regard.

To achieve this aspiration, Africa needs to offer contextually relevant solutions and valuation mechanisms that are fit for purpose, consider the peculiarity of our building systems and the comparable higher durability. We must also anticipate future economic, social, and geographic occurrences and their impact on asset values.

In Africa, assets, especially houses, offer more than a monetary value. Assets may have ancestral relevance, must never be flipped in an economic exchange or sale, and are often appreciated beyond monetary value.

I suggest that professionals such as yourselves reinforce the unique value proposition of Africa and espouse cherished and touted African values in valuation mechanisms. Professionals must measure their relevance beyond a mere regulatory anchor that insists people use their services.

Do not get me wrong – regulation is critical to promote sustainable cohesion, growth, and development. However, professionals must always ask if people will voluntarily request their services if there is no regulatory requirement.

I am encouraging your Institution to take up the challenge and embark on a massive outreach to engage Nigerians. Professionals have often assumed that being technically competent is enough to sustain their relevance.

Well, it is not. For instance, the number of technical jargons in your reports can be reconsidered, especially from the end user’s perspective. Ultimately, your service is to your clients, who may not always be as technically apt as you are.

Related to this is the number of disclaimers that accompany most of your reports, almost absolving valuers from significant professional misconduct and abuse. This may require a critical reconsideration.

Asset valuation service users may require asset valuation for several reasons. At the very minimum, asset valuation must identify the right price for an asset so that the purchaser does not mistakenly overpay for the acquisition, nor does the seller erroneously accept a discounted price. This means all parties, without any moral hazard, can determine the actual value of the business in the event two companies merge or one firm acquires another.

Mr Chairman, we must agree that if we are to improve asset valuation in the quest to tackle corruption globally, there must be a limit to using arbitrary powers for asset valuation. Instead, we should amplify tried and tested distinct methods that rely on valuation standards.

Overstating the assets and understating their liabilities has led to the crash of some multinational corporations and had reverberating effect on the whole world economy. In the United States, as recent as the late 2000s, the failure of real estate appraisers to abide by standards led to overvalued properties that are perceived to have contributed to significant mortgage defaults, which impaired the capital reserves and operating ability of many financial institutions and led to a crisis in the world financial system that spread beyond the borders of the US.

As a person who has served in public office at the highest level, let me tease your minds by raising the issue of the requirement for public officers to declare their assets prior to taking office and upon exit from office. This regime of declaration of assets is a useful tool in the fight against corruption, but in many cases is not utilized to maximum effect.

The assets declaration forms must be filled by the individual prospective public office holder. In Ghana, the individual is asked to list all assets and properties they own. Examples are houses, farms, vehicles, jewellery etc. You are also required to assign values to each of these assets.

How will physical examination of assets and valuation assist to strengthen the assets declaration regime to assist the fight against corruption? What role can the determination of the net worth of a public officer before and after office assist in curbing the canker of corruption.

It is good practice that valuation or appraisal organisations require their members to adhere to a particular set of standards. The American Society of Appraisers (ASA) and the Royal Institute of Chartered Surveyors (RICS) insist on standards and performance measurements partly because they wish to avoid the mistakes of their past.

Performance measurement is not an exact science, but I urge you to allow these indices to guide your noble efforts borne out of your intrinsic motivation to right the wrongs of the past. The Lagos State Real Estate Regulatory Authority, beneficial ownership legislation, and the development of an online portal for planning applications have brought more clarity for example. Through transparency, Nigeria can better tackle corruption in the real estate sector.

Mr Chairman, Surveyor President, Distinguished Ladies and Gentlemen, my speech has mapped out asset valuation as a vital tool for national development. We are yet to maximise the potential of asset valuation as a tool for nation-building and anti-corruption. Let us constantly strive to improve and enforce existing global anti-corruption conventions designed to curtail the negative impacts of corruption on national economies.

In addition to the Institution’s efforts, Estate Surveying and Valuation Companies must adhere to laws and standards and take internal steps to prevent corruption in asset valuation. Please also partner with government to implement global standards and national professional codes of conduct and standards.

Finally, the Nigerian Institution of Estate Surveyors and Valuers must champion efforts to enhance real-time data availability, improve technology adoption for land and real estate services online, and formulate relevant legislation for property management.

With the leadership and commitment of the NIESV, asset valuation as a global anti-corruption tool will take firm roots in Nigeria with the hope that the giant of West Africa will rise again and soar like the eagle that calls its compatriots to obey.

Thank You.

Source: johnmahama.org