The Government of Ghana on Sunday, December 4, 2022, announced a Debt Restructuring Programme asking local bondholders to voluntarily exchange their existing bonds for new ones.

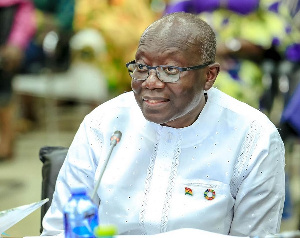

The new agreement among other things, will replace existing local-currency debt with four new bonds maturing in 2027, 2029, 2032 and 2037; Finance Minister Ken Ofori-Atta said.

This has seen government entreat local bondholders to accept losses on interest payments set at 0% in 2023, 5% in 2024 and 10% from 2025.

But before arriving at the announcement, the government had sought to engage in a unilateral imposition of Collective Action Clauses on bondholders.

The Ministry of Finance in a letter to the Attorney General requested for advice as it sought to “explore legally and constitutionally acceptable alternatives or complementary approaches on the form of mechanism that would enable the use of Collective Action Clauses (CAC) designed to allow a qualifying majority of bondholders to agree to debt operation terms on their bonds and make the resulting changes binding on dissenting creditors.”

The government among other things, sought to do this through various options including the use of executive actions such as an Executive Instrument (E. I.).

But the Attorney General, Godfred Yeboah Dame, in a piece of legal advice issued on November 18, 2022, advised the government against going on such a path.

“The process of the government undertaking debt restructuring does not fall within the confines of articles 21 and 31 of the Constitution.

“Debt restructuring which may require the Government to vary terms of its bond agreements will not constitute an emergency situation permitting the president to invoke the emergency powers conferred upon him by the Constitution.”

The Attorney General, Godfred Yeboah Dame, further explained that “Even though Governments are entitled to issue executive instruments or to take measures, as provided in Act 982 to address issues of unforeseen economic shocks, doing so to impose CACs on bondholders may amount to a unilateral modification of a bond agreement which is also the product of the exercise of an executive action of government in its commercial capacity.”

The A-G thus asked the government to engage bondholders and relevant parties to arrive at a voluntary agreement in order to make a debt restructuring programme successful.

On the back of the A-G’s advice, the government announced its debt restructuring programme, albeit asking bondholders to voluntarily accept the agreement.

Despite stating that the exercise is voluntary for bondholders, the government in another breath is serving the bondholders a raw deal.

Deputy Minister for Finance, John Kumah, while explaining the enormity of the challenge faced by the Government of Ghana, painted a take-or-take situation for anxious bondholders who may have issues in agreeing to the government’s terms.

According to him, bondholders who may dissent to the debt exchange programme will not “get the carrots, the benefits, the buffers that are provided.”

“You are on your own, it means that you are open to default in terms of if the markets are unable to redeem (the bonds),” the deputy minister added.

While some bondholders may be struggling to reorient themselves from being dazed by the government’s hard-biting debt exchange programme, they have been given 10 days beginning from December 6 to sign on for the government’s offer.

And while some disgruntled bondholders may be considering legal redress, Mr John Kuma says Ghana is a “man of straw” with a “broken system” for which such a venture will prove futile.

Already, various institutional bondholders have flatly rejected the government’s debt exchange programme.

Source: ghanaweb.com