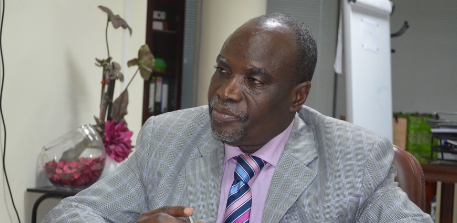

Former Chief Executive of the National Petroleum Authority (NPA), Moses Asaga has shot down the idea of the government’s use of gold to buy oil from the international market.

The former Member of Parliament for the Nabdam constituency in the Upper East Region said that it is not a brilliant idea to buy oil with gold because the total consumption of oil per year against the country’s gold receipts that go through the Bank of Ghana per year do not tally.

“Our total refined product including LPG, petrol, and diesel was almost $4 billion per year which could have even increased by now. So, if we import $4 billion worth of refined product, how can the receipt of gold be able to match the $4 billion? That is where I think the Vice President didn’t really go deep to do his analysis, unless this is just a temporary measure.”

The former CEO expressed worry over the deliberate neglect of the National Petroleum Authority from the deal, knowing very it is the authority mandated to regulate and ensure the supply of petroleum products across the country.

“If you are dealing with gold in exchange for refined products, the NPA should be involved in this because it is the NPA that has all the statistics and figures. Our total bullion gold reserve is 8.7 tons that we have been accumulating all these years. And if you have 8.7 tons and multiply that by 36,000 ounces and further multiply that by $1,700 per ounce, it brings us to $500 million. That is what we are holding today in our bullion at 8.7 tons of gold. So, if you have $500 million, how can this translate into collateral for a product worth over $4 billion?”

The idea of using gold to buy oil was first made by the Vice President, Dr. Mahamudu Bawumia in a Facebook post which he said is needed to tackle the country’s dwindling foreign exchange reserves which have resulted in the depreciation of the cedi.

The Vice President’s post which was widely reported partly said: “The demand for foreign exchange by oil importers in the face of dwindling foreign exchange reserves results in the depreciation of the cedi and increases in the cost of living with higher prices for fuel, transportation, utilities, etc. To address this challenge, the Government is negotiating a new policy regime where our gold (rather than our US dollar reserves) will be used to buy oil products.”

Enumerating the benefits Ghana is expected to derive from the policy, Dr. Bawumia added that “the barter of sustainably mined gold for oil is one of the most important economic policy changes in Ghana since its independence. If we implement it as envisioned, it will fundamentally change our balance of payments and significantly reduce the persistent depreciation of our currency with its associated increases in fuel, electricity, water, transport, and food prices.”

“This is because the exchange rate (spot or forward) will no longer directly enter the formula for the determination of fuel or utility prices, since all the domestic sellers of fuel will no longer need foreign exchange to import oil products. The barter of gold for oil represents a major structural change. My thanks to the Ministers for Lands and Natural Resources, Energy, and Finance, Precious Minerals Marketing Company, The Ghana Chamber of Mines and the Governor of the Bank of Ghana for their supportive work on this new policy. We expect this new framework to be fully operational by the end of the first quarter of 2023.”

Source: citinewsroom.com