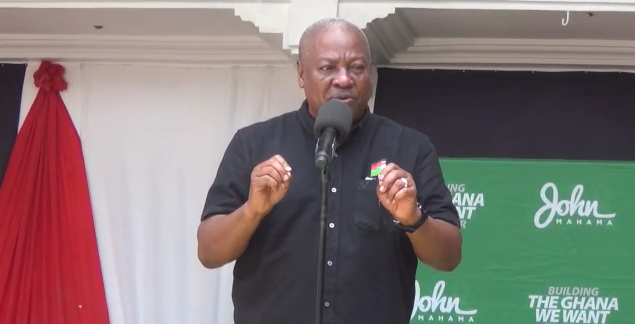

Flagbearer of the National Democratic Congress (NDC), John Mahama, has announced plans to establish a National Fintech Strategy should he be elected President.

The strategy, he asserts, will curtail technology-induced fraud in the banking, insurance, and investment ecosystem and allow for smooth operations in the sector.

According to him, this approach ensures that Ghana is not left behind in the fast-paced technologically advanced world.

Addressing players in Fintech at a meeting in Accra on March 15, he said “As digitalisation gathers momentum, we risk leaving behind a section of the financial service industry due to unequal access to digital resources. The resources required for developing, delivering, and managing digital financial services prevent some specialised deposit-taking institutions, insurance companies, investment companies, and pension service providers from being responsive to their customers.

“Certainly, the inability of these entities to tap into the benefit of digitalisation will deprive the financial service industry of the full benefit that digitalisation offers.”

On the back of this, he assured that his administration would ensure that this technological gap is breached.

“To address the technology gap, the next NDC government will actively encourage Fintech to share infrastructure in a cost-effective manner.

“Ladies and gentlemen finally within the context of our National Fintech strategy to be co-created with you stakeholders, we shall implement an electronic know your consumer (EKYC) system and digital passporting or credentials, pursue fraud monitoring, and set up a blacklisted persons database. To enhance digital literacy, we will explore the use of artificial intelligence to provide exciting tools for the societal environment and friendly anchor the Fintech industry within the Ghana National Cyber Security Strategy.”

He continued “We shall streamline regulation. The next NDC government will improve the regulatory, and supervisory environment to encourage active participation and healthy competition amongst diverse players within the Fintech space.

“Diversity and competition drive innovation and enhance user experience but I know that young persons with brilliant ideas eager to contribute their quota to the National Agenda are facing rigidities in their application processes and the generally difficult and financially constraining Fintech operational environment. I will actively ensure Ghanaian participation in the buoyant, diverse, and competitive Fintech Ecosystem for the ultimate benefit of our people.”

Meanwhile, he assured Ghanaians that the process to acquire a license would not be politicised. He pledged that equal access would be afforded to ordinary Ghanaians to apply for licensing.

“Your license as a Fintech is a bag of approval that permits you to provide a regulated service trusted by the public and it should be cherished.

“Nevertheless, the cost of compliance is too heavy on entities whose platforms provide services that cut across different regulatory jurisdictions such as insurance payment, pensions, savings, credit, and investments. To resolve this a more collaborative regulatory regime facilitated by technology will be implemented to bring greater innovation, dismantle needless dependencies, and provide efficiency and affordability,” he added.

Also, the NDC flagbearer said he would set up a $50 million Fintech Transformative Growth Fund to address the financial needs of Ghanaian-owned Fintech.

Source: myjoyonline.com