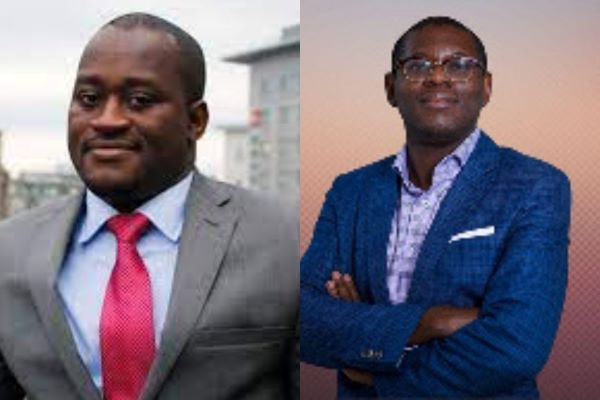

The Vice President of IMANI Africa, Bright Simons, has responded to Economist and Risk Analyst, Dr. Theo Acheampong over the existence of a personal credit-scoring system in Ghana.

Bright Simons, in response to Dr Acheampong’s claim that no such system exists, countered by stating that there are credit scoring agencies operating in the country called the Credit Bureaus that issues scores in addition to reports.

The disagreement stemmed from Vice President Dr Mahamudu Bawumia’s announcement that there are plans to introduce a personalised credit-scoring system in Ghana by 2024.

When the concept was announced by Dr Bawumia, Bright Simons raised questions about the need for rating systems.

Dr. Theo Acheampong, who saw the need for a credit scoring system, stated that the Vice President was right, stating that there is currently no individualised credit-scoring system in place.

However, Bright Simons, on November 30, 2023, in a post on X to challenge Dr Acheampong’s assertion, insisted that the economist is not familiar with the credit-scoring landscape in Ghana.

“Been busy with meetings all day so I’ve not had time to respond to Theo & Gideon Boako. I will do that later today (30th Nov). Simple response to Theo: he is wrong & not familiar with this area in Ghana. The Credit Bureaus in Ghana issue SCORES in addition to reports!” he reiterated.

Presently there are two credit rating organisations licenced by the Bank of Ghana (BoG) to operate.

They are Dun and Bradstreet Credit Bureau Limited and XDS Data Ghana.

/

Been busy with meetings all day so I've not had time to respond to Theo & Gideon Boako. I will do that later today (30th Nov). Simple response to Theo: he is wrong & not familiar with this area in Ghana. The Credit Bureaus in Ghana issue SCORES in addition to reports! https://t.co/GfsMvbUT8W— Bright Simons (@BBSimons) November 30, 2023

Source: ghanaweb.com